How crypto tokens will outperform stocks in 2023

Crypto tokens are on track to outperform stocks in 2023, according to Jeff Dorman, chief investment officer of Arca.

Crypto tokens are on track to outperform stocks in 2023, according to Jeff Dorman chief investment officer of Arca interview, a digital asset investment firm.

In a recent interview with Cointelegraph, Dorman explained that there are a number of factors that will contribute to the outperformance of crypto tokens, including:

- Macroeconomic factors: The global economy is facing a number of challenges, including high inflation, rising interest rates, and a potential recession. These challenges are likely to weigh on stock prices in 2023.

- Technological innovation: The crypto industry is constantly innovating, with new projects and technologies being launched on a regular basis. This innovation is attracting new users and investors to the crypto space.

- Institutional adoption: Institutional investors are increasingly allocating capital to crypto assets. This institutional adoption is providing additional support for crypto prices.

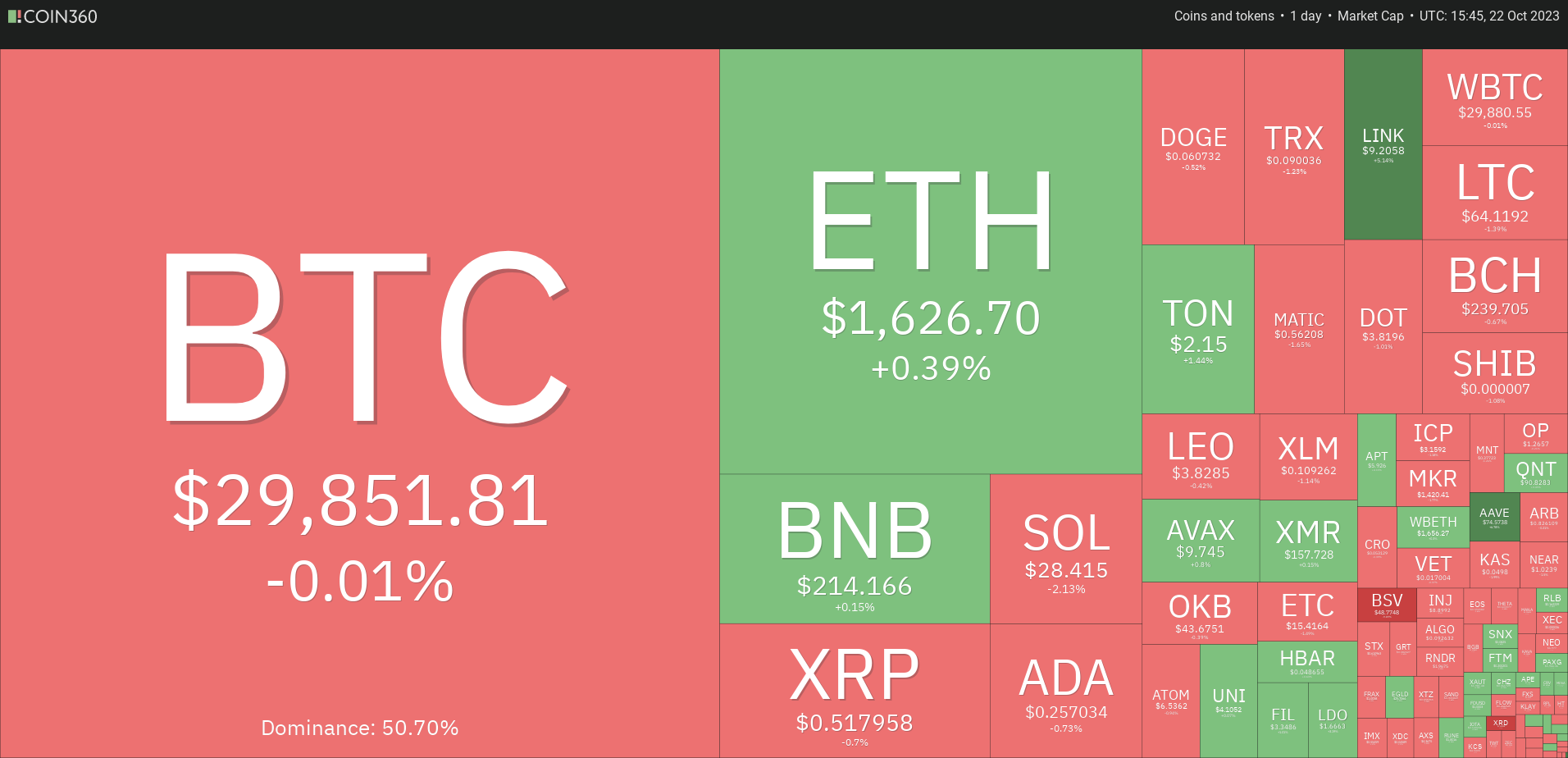

Dorman believes that Bitcoin, the world?s largest cryptocurrency, is unlikely to outperform stocks in 2023. This is because Bitcoin is more correlated with stocks than other crypto assets.

However, Dorman believes that other crypto token, such as Ethereum, Solana, and Avalanche, are well-positioned to outperform stocks in 2023. These tokens are less correlated with stocks and have more upside potential.

How crypto tokens can outperform stocks

Crypto tokens can outperform stocks in a number of ways.

First, crypto tokens are less correlated with stocks than traditional assets. This means that crypto token are less likely to be affected by negative macroeconomic conditions.

Second, the crypto industry is constantly innovating, with new projects and technologies being launched on a regular basis. This innovation is attracting new users and investors to the crypto space, which is driving up the demand for crypto tokens.

Third, institutional investors are increasingly allocating capital to crypto assets. This institutional adoption is providing additional support for crypto prices.

Why Bitcoin may not outperform stocks

Bitcoin, the world?s largest cryptocurrency, is more correlated with stocks than other crypto assets. This means that Bitcoin is more likely to be affected by negative macroeconomic conditions.

In addition, Bitcoin is a relatively mature asset class. This means that it has less upside potential than other crypto token.

Which crypto tokens are likely to outperform stocks in 2023?

Some crypto tokens that are likely to outperform stocks in 2023 include:

- Ethereum (ETH): Ethereum is the second-largest cryptocurrency and the leading platform for decentralized applications (DApps). Ethereum is undergoing a major upgrade known as ?The Merge,? which is expected to make the network more scalable and efficient.

- Solana (SOL): Solana is a layer-1 blockchain that is known for its high scalability and low transaction fees. Solana is home to a growing ecosystem of DApps and protocols.

- Avalanche (AVAX): Avalanche is another layer-1 blockchain that is known for its high scalability and low transaction fees. Avalanche is also home to a growing ecosystem of DApps and protocols.

Crypto tokens are on track to outperform stocks in 2023, according to Jeff Dorman, chief investment officer of Arca.

There are a number of factors that will contribute to the outperformance of crypto token, including macroeconomic factors, technological innovation, and institutional adoption.

Some crypto tokens that are likely to outperform stocks in 2023 include Ethereum (ETH), Solana (SOL), and Avalanche (AVAX).

What's Your Reaction?