Bitcoin Price Cracks $30K, Possibly Clearing a Path for SOL, LINK, AAVE, and STX

Explore how Bitcoin Price Clearing Path surge to $30K could be paving the way for SOL, LINK, AAVE, and STX.

Bitcoin Price Cracks $30K, Possibly Clearing a Path for SOL, LINK, AAVE, and STX in 2023

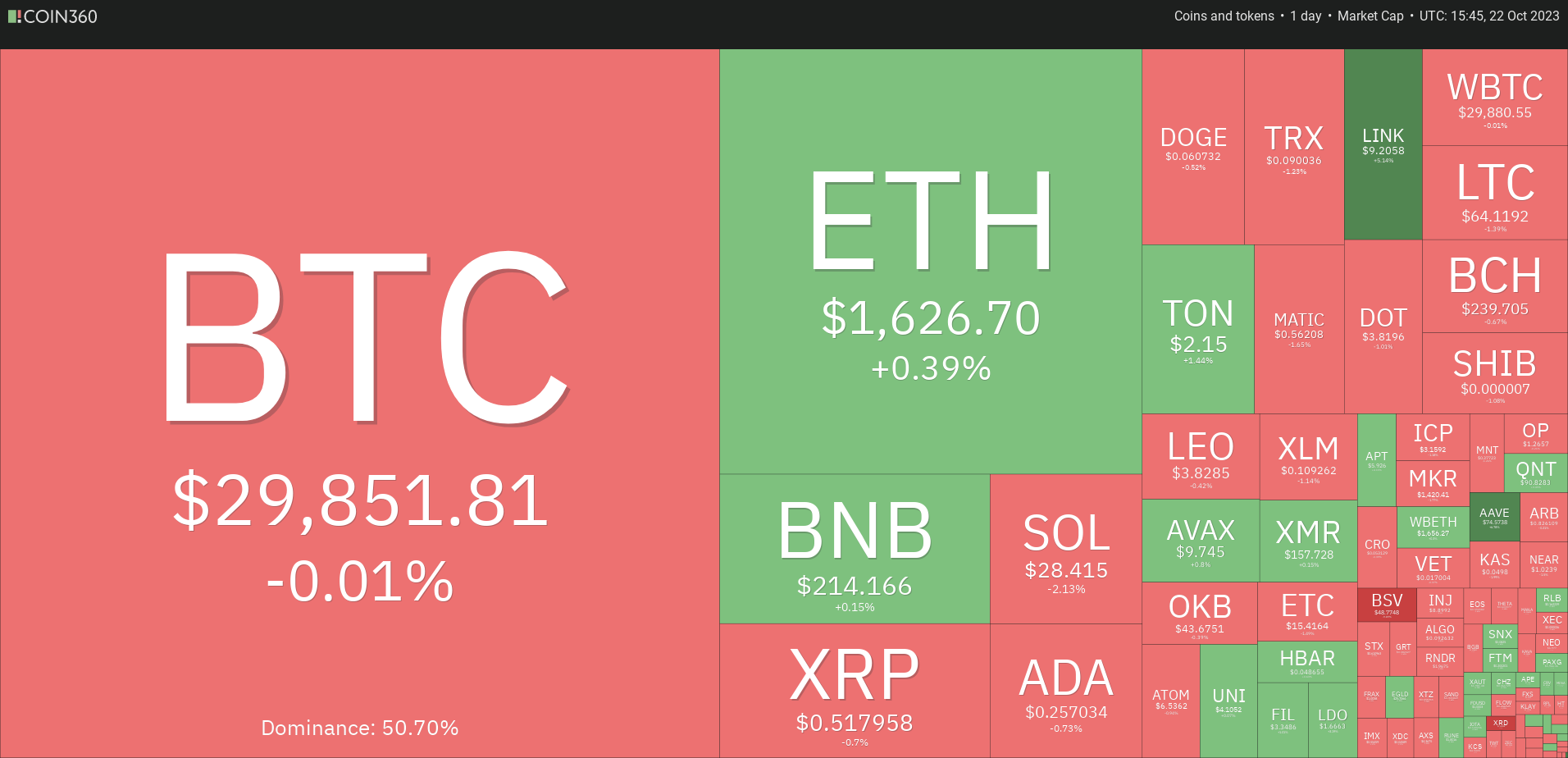

Bitcoin Price Clearing Path recently cracked $30,000, a significant milestone that could signal a broader recovery for the cryptocurrency market. Bitcoin's price has been relatively stagnant in recent months, but the recent rally has given investors hope that a bullish reversal is underway.

Bitcoin's rise to $30,000 could have positive implications for other cryptocurrencies, including Solana (SOL), Chainlink (LINK), Aave (AAVE), and Stacks (STX). These cryptocurrencies are all considered to be among the most promising projects in the space, and they could benefit from a rising tide for all crypto market today.

Solana

Solana is a high-performance blockchain platform that is capable of processing thousands of transactions per second. Solana has been gaining popularity in recent months due to its speed, scalability, and low transaction fees.

Solana is also home to a growing ecosystem of decentralized applications (dApps), including DeFi protocols, NFT marketplaces, and gaming platforms. The recent growth of the Solana ecosystem has helped to drive demand for the SOL token.

Chainlink

Chainlink is a decentralized oracle network that provides real-world data to smart contracts. Chainlink is used by a wide range of DeFi protocols to power their applications.

Chainlink is also used by other blockchain projects, such as Polkadot and Polygon, to provide secure and reliable data feeds. The growing demand for Chainlink's services has helped to boost the demand for the LINK token.

Aave

Aave is a decentralized lending and borrowing protocol that allows users to borrow and lend assets without the need for a trusted intermediary. Aave is one of the most popular DeFi protocols, with over $10 billion in total value locked (TVL).

Aave's popularity is due to its flexibility and ease of use. Aave users can borrow and lend a wide range of assets, including Bitcoin, Ethereum, and stablecoins. Aave also offers attractive interest rates on deposits and loans.

Stacks

Stacks is a layer-1 blockchain that brings smart contracts and decentralized applications (dApps) to Bitcoin. Stacks uses Bitcoin as its base layer, which provides it with security and scalability.

Stacks is home to a growing ecosystem of dApps, including DeFi protocols, NFT marketplaces, and gaming platforms. The recent growth of the Stacks ecosystem has helped to drive demand for the STX token.

Potential Impact on SOL, LINK, AAVE, and STX

Bitcoin's rise to $30,000 could have a positive impact on SOL, LINK, AAVE, and STX. These cryptocurrencies are all considered to be among the most promising projects in the space, and they could benefit from a rising tide for all crypto market prediction.

If Bitcoin's price continues to rise, it could attract new investors to the cryptocurrency market. This could lead to increased demand for all cryptocurrencies, including SOL, LINK, AAVE, and STX.

Additionally, Bitcoin's rise could boost confidence in the cryptocurrency market as a whole. This could lead to increased investment in cryptocurrency projects and a rise in the prices of all cryptocurrencies, including SOL, LINK, AAVE, and STX.

Bitcoin's recent rise to $30,000 is a positive sign for the cryptocurrency market as a whole. If Bitcoin's price continues to rise, it could have a positive impact on other cryptocurrencies, including SOL, LINK, AAVE, and STX.

These cryptocurrencies are all considered to be among the most promising projects in the space, and they could benefit from a rising tide for all cryptocurrencies.

Additional Information

In addition to the information above, here are some other factors that could impact the prices of SOL, LINK, AAVE, and STX in 2023:

- The overall state of the cryptocurrency market:?If the cryptocurrency market continues to grow and attract new investors, it could lead to higher prices for all cryptocurrencies, including SOL, LINK, AAVE, and STX.

- The adoption of decentralized applications (dApps):?The adoption of dApps is one of the key drivers of growth for the cryptocurrency market. If dApps continue to gain popularity, it could lead to increased demand for SOL, LINK, AAVE, and STX, as these cryptocurrencies are all used by dApps.

- Regulatory developments:?The regulatory landscape for cryptocurrencies is still evolving, and regulatory developments could have a significant impact on the prices of cryptocurrencies. If governments adopt favorable regulations for cryptocurrencies, it could lead to higher prices for all cryptocurrencies, including SOL, LINK, AAVE, and STX.

However, it is important to note that the crypto stock price market is still volatile, and there is no guarantee that these cryptocurrencies will continue to rise in price. Investors should always do their own research before investing in any cryptocurrency.

Here are some specific factors that could contribute to the growth of SOL, LINK, AAVE, and STX in 2023:

- The launch of new products and features:?All four of these projects are actively developing new products and features that could help them to attract new users and increase demand for their tokens. For example, Solana is working on a new Layer 2 scaling solution that could make it even more efficient and scalable. Chainlink is working on new oracle protocols that could make it easier for developers to build decentralized applications. Aave is working on new lending and borrowing products that could make it more accessible to users. And Stacks is working on new bridges and integrations that could make it easier for users to move assets between Bitcoin and Stacks.

- The growth of DeFi: DeFi is one of the fastest-growing sectors of the live cryptocurrency prices market, and all four of these projects are well-positioned to benefit from this growth. For example, Solana is a popular platform for DeFi applications, and Chainlink is used by many DeFi protocols to provide real-world data. Aave is one of the leading DeFi lending and borrowing protocols, and Stacks is being used to build new DeFi applications on Bitcoin.

- The adoption of NFTs:?NFTs are another rapidly growing sector of the cryptocurrency market, and all four of these projects are involved in the NFT space. For example, Solana is a popular platform for NFT marketplaces, and Chainlink is used by some NFT projects to provide price feeds and other data. Aave is being used to build new NFT lending and borrowing protocols, and Stacks is being used to build new NFT applications on Bitcoin.

Overall, the outlook for SOL, LINK, AAVE, and STX in 2023 is positive. These projects are all well-positioned to benefit from the growth of the cryptocurrency market, the growth of DeFi, and the adoption of NFTs. However, investors should always do their own research before investing in any cryptocurrency.

What's Your Reaction?